Make money with active and passive income because both are important. We need active income for our daily expenses and to raise money to start passive income.

This post is a continuation of How to get and develop ability to make money. Again, I am writing from what I learned from the webinar “Life Talks: The Ability to Produce Wealth – Made Practical with Chinkee Tan.“

Key lessons learned Part 2

Active and passive income: what’s the difference?

Active income is the pay we get for the services we give. These are from the jobs we take where we get paid hourly, daily, weekly, monthly, or annually. It can also be the income after we finish a task or a project. It includes commissions, tips, and other benefits we get while working. If we don’t work, we don’t earn anything. In essence, producing active income is through “man at work.”

On the other hand, passive income is what we get when we invest money, time, and effort into something with an expectation of return at a later date, even with no more active and direct involvement. With passive income, making money continues even without additional effort after some time. Thus, producing passive income is through “money at work.”

Active and passive income: Which is better?

We might ask which the better one is.

As we know, everyone invests in education mostly to have good jobs in the future. Hence, we are used to investing more for active income. However, a time will come when we can no longer work, but we still need money, if not for enjoyment, at least for continuing to live. So then we realize we need to have income even when we no longer can work.

“The reality is this: there will come a day that you and I will stop working. The moment you and I stop working, we stop earning. But the problem is we don’t stop spending. So we have to come to a point in our lives that we don’t rely only on active income. We should also earn from passive income, especially for those people who want to retire.” – Mr. Chinkee Tan

Thus, the better source of income is passive income, at least for retirement. It is everyone’s dream of earning money even without working. Many advertisements use the terms financial freedom, time freedom, living our dreams such as traveling to attract people to invest. Who wouldn’t be interested in having passive income and achieving freedom to live our dreams?

Active and passive income: Why should we have both?

To have passive income, we need to invest our time, effort, and money. It’s much like investing in education or skill-building to have jobs or active income. However, where do we get our capital for investing in passive income?

From our active income, but we have to strategize or make a plan.

For Mr. Chinkee Tan, the strategy is to transfer income from active to passive.

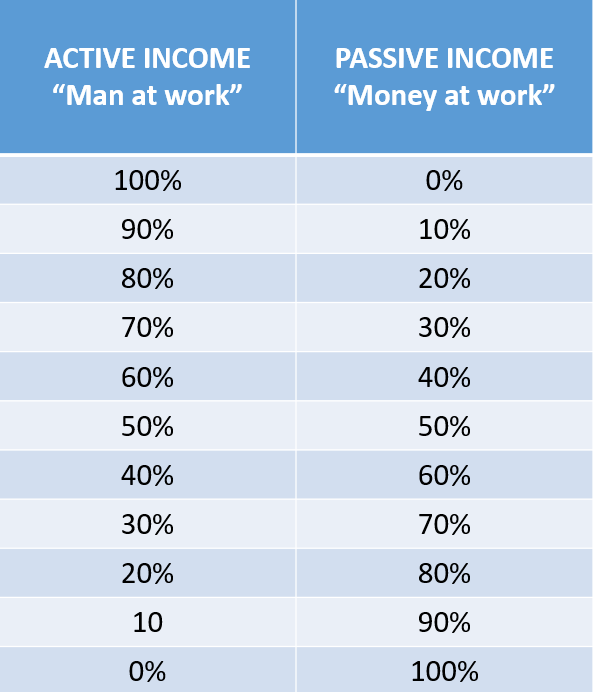

If you can see on the left side is active income. On the right side is passive income. So most of us, 100% active income and then 0% passive.

As early as right now, what we should do is develop a way that our active income is 90% and passive 10%. […] then 10% : 90%. As we age, we have to slowly transfer our income from active to passive. – Mr. Tan

How to turn an active income into a passive income

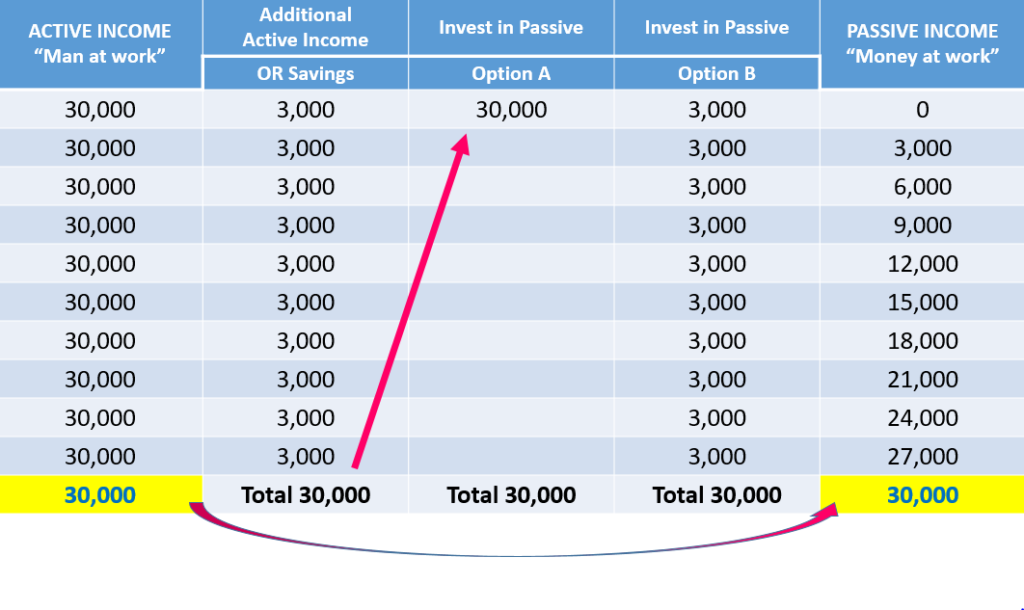

I have created another chart to see how we can turn our active income into a passive one.

Let’s say that our income is 30,000 pesos a month. If we can save 3,000 from our monthly income, we can wait until our savings accumulate to a certain amount we need as capital. We may say our monthly income is just enough for our basic needs, and there’s no way to save some. We still have an option: to find a way to have an additional income.

Another option is to invest the savings or the additional income directly to something we choose as a way to earn passive income. There are some ways that may need only small capital. Then we can just add more monthly for the investment to grow bigger.

From the chart, we can see that the passive income can grow bigger. There will also be a time when this income can equal and then grow bigger than our active income. Hence, pretty soon or late we can decide to quit our job and retire as our passive income grows.

Naturally, it’s easier said than done. Honestly, more often it really takes time, sometimes, a long time for the passive income to grow.

Thus, the next post will be about the principles to follow so that we can make money that lasts through our lifetime.